Cuentas Prepaid Mastercard® app for iPhone and iPad

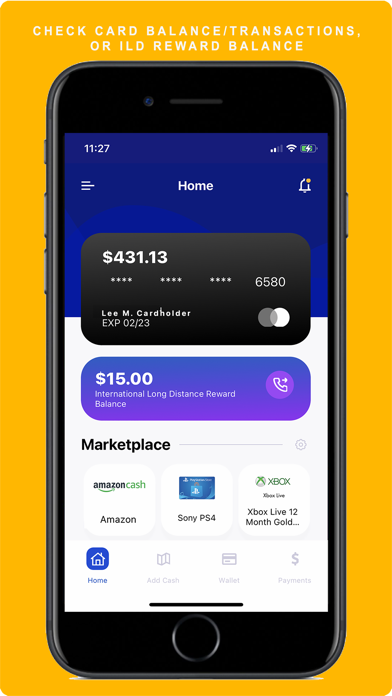

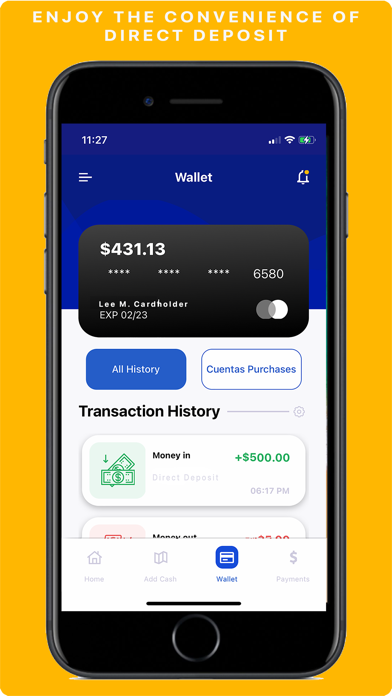

The Cuentas Prepaid Mastercard® is a mobile app that lets you manage your money on the go. With features like no credit check and no fee direct deposit, you can check your balance at any time to stay in control of your money. Transfer money to another Cuentas cardholder for free, receive your direct deposit up to 2 days earlier, conveniently make online purchases, pay for groceries, and pay your bills. The Cuentas Prepaid Mastercard® funds are FDIC insured and can be used wherever debit Mastercard® is accepted.

Sign Up for the Cuentas Prepaid Mastercard® today to receive $5 of free International Long-Distance credit. Cuentas cardholders also enjoy discounts from top brands like: Amazon Cash, AT&T, Playstation, Verizon, XBOX, Burger King and more within the Cuentas Store in-app.

Cuentas Prepaid Mastercard® is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International. Terms and conditions apply.

How to qualify:

- You must be over 18 years old

- Have a valid ITIN/SSN and any of the following government IDs from the USA and Other Select Countries:

o Passport

o Driver’s License

o Matricula Consular ID

o US Resident “Green” Card

o H-1B Visa card

o Other Government ID

- Have a physical address in the US

Cardholder benefits:

• No credit check or background check

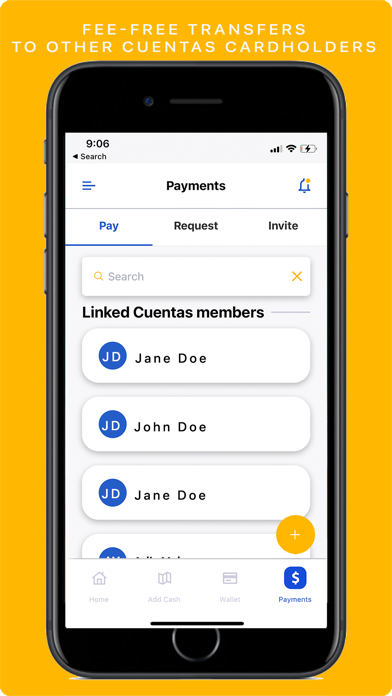

• Fee Free transfer of funds from Cuentas cardholders to Cuentas cardholders

• No Fee Direct Deposit for paychecks or government issued checks

• Add funds at over 200,000 VanillaDirect Load locations

• Earn $5.00 in International Long-Distance Minutes upon registration

• Discounts from top brands in the Cuentas Store

• Withdraw funds at ATM cash machines and banks

• Valid in countries where debit Mastercard® is accepted

• No minimum balance required

• Set up account alerts to stay in control of your money

• See the Cardholder Agreement for details and limits